10 Loan Programs to Help You Secure a Home Now

A lot of buyers are sitting on the sidelines, waiting for the “perfect” time to enter the real estate market. Maybe you’ve told yourself you don’t qualify because you’re self-employed, you don’t have a big down payment, or your income looks complicated on paper. The good news is there are non-traditional mortgage loan programs designed specifically to help people in your situation. In fact, this list of 10 Loan Programs To Help You Secure a Home Now highlights real solutions for anyone wondering how to qualify for a home loan in today’s market.

1. Business Bank Statement Loans

Traditional loans require W-2s and tax returns, which can punish business owners for taking legal write-offs. With this program, lenders look at your business bank deposits instead.

Example: Imagine you run a successful design studio and write off half your expenses. Your tax return says you “make” $50k, but your bank deposits show $200k. With a bank statement loan program, you’re approved based on a percentage of your gross business deposits, not the net taxable income on your tax returns.

2. Personal Bank Statement Loans

If your income runs through personal accounts — freelance, gig work, consulting — this program looks at 12–24 months of personal bank deposits to verify income.

Example: A freelance writer with fluctuating monthly checks shows steady deposits over 18 months, enough to qualify without needing W-2s.

3. Profit & Loss (P&L) Loans

Instead of submitting years of tax returns, you can use a CPA-prepared profit and loss statement to qualify.

Example: A boutique owner with complicated books provides a clean P&L showing consistent profits, which becomes the basis for approval.

4. DSCR (Debt Service Coverage Ratio) Loans

For investors, DSCR loans qualify the property based on rental income instead of your personal income. If the rent covers the mortgage, you’re good to go.

Example: You buy a fourplex where projected rent is $6,000 and the mortgage is $5,200. Since the rent covers the debt, you qualify.

5. Down Payment Assistance (DPA) Programs

The number one barrier for many buyers is saving enough for the down payment. DPA programs provide grants or low-interest secondary loans to help cover it.

Example: Instead of needing $40,000 cash, a first-time buyer uses a DPA grant to cover half, cutting years off the waiting game.

6. CRA (Community Reinvestment Act) Programs

Banks offer special loans in certain neighborhoods with reduced down payments, lower rates, or more flexible underwriting as part of community investment requirements.

Example: Buying in a CRA-designated area could mean 3% down and a better interest rate than a conventional loan.

7. Interest-Only Loans

These loans let you pay just the interest for the first 5–10 years, keeping payments low while you build income or invest elsewhere.

Example: A young attorney expects large raises in the coming years. An interest-only loan keeps payments low now while she grows into the mortgage.

8. 10% Down on Homes Up to $5M

Think jumbo loans are out of reach? Some programs allow just 10% down for homes priced up to $5 million.

Example: Instead of tying up $500,000 on a $2M home, you put down $200,000 and finance the rest — keeping $300,000 liquid.

9. Piggyback Loans (1st + 2nd Mortgage)

This strategy uses two loans — one for 80% of the home price and another for 10–15% — to help you avoid private mortgage insurance (PMI).

Example: A family buys a $700k home with 10% down. Their piggyback loan avoids PMI and jumbo pricing, saving hundreds per month.

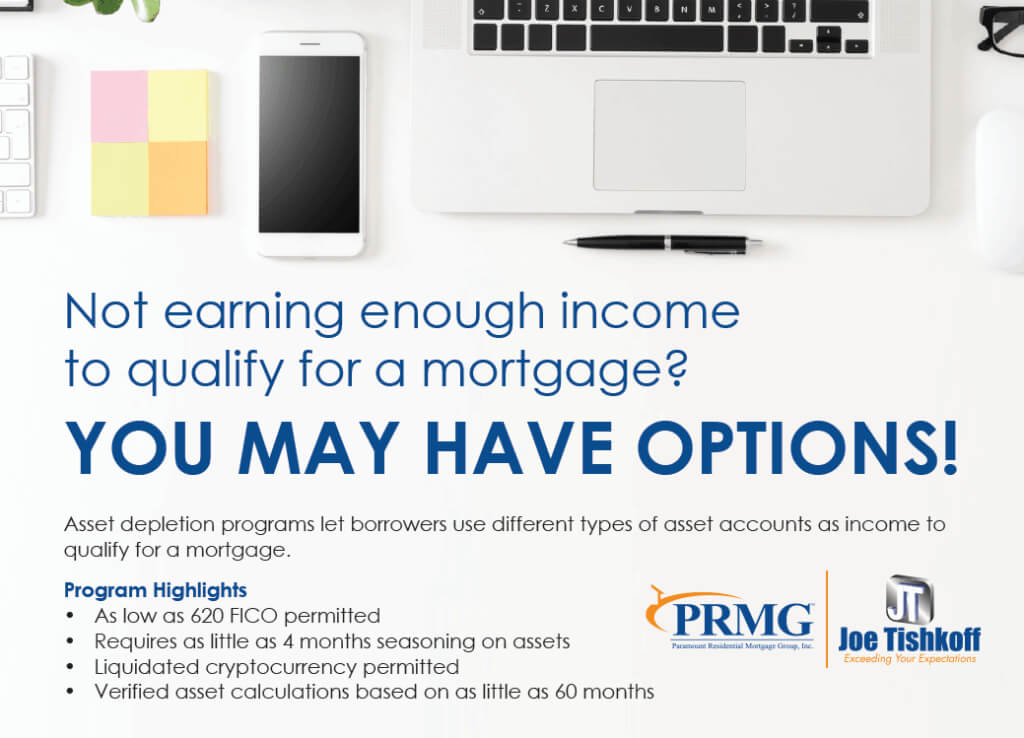

10. Asset Depletion Loans

If you don’t have steady income but you do have assets — savings, investments, retirement accounts — lenders can calculate a monthly “income” from those assets.

Example: A retired couple with $1.2M in investments and no W-2 income still qualifies, because the assets are divided over a set number of years to count as income.

The Bottom Line

Qualifying for a mortgage isn’t one-size-fits-all. Whether you’re looking for loan options for self-employed, exploring creative financing strategies, or searching for low down payment home loans, the right program can help you move forward.

Waiting doesn’t make buying easier — it makes it harder as prices and rents rise. The smartest move is to explore these non-traditional mortgage loan programs with a professional who knows which loan best fits your situation.

The opportunity is there. The only question is: are you ready to take it?

Comments open